In 2016, the UK government set up an independent advisory group to answer an important question: “How can the providers of savings, pensions and investments engage with individuals to enable them to support more easily the things that they care about through their savings and investment choices?”

Their findings were published in a report titled “Growing a Culture of Social Impact Investing in the UK”, commonly known as the Corley Report, after Elizabeth Corley, vice chair at Allianz Global Investors who lead the group of experts.

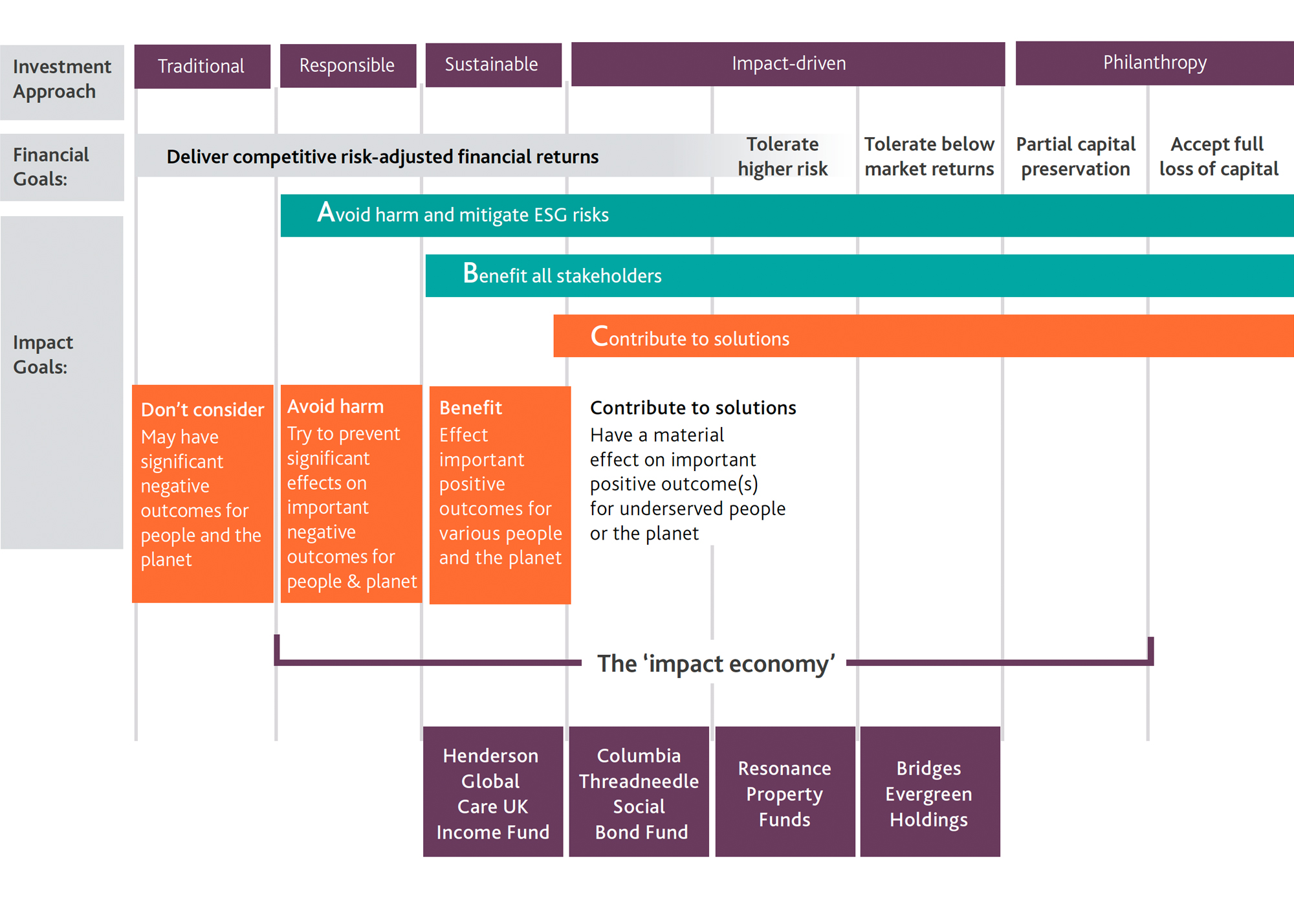

A section of the report maps the way that a broad range of risk/return strategies in sustainable and social impact investing, from investing for maximum profit to so called “concessionary” investment – the option that financial return can be traded off for social return. This map is called The Spectrum of Capital.

The spectrum of capital is a great way of showing how different investment approaches, and their financial goals, align to the impact they make on both people and the planet.

The Resonance Property Funds were used as an example of an impact driven investment approach that combines high impact with a risk adjusted return for investors.

Sign up today and keep up to date with all our latest social impact news, innovations and insights so you never miss a thing.